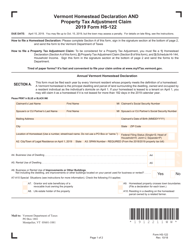

vermont department of taxes homestead declaration

BUYING AND SELLING PROPERTY Buying on or before. Use Get Form or simply click on the template preview to open it in the editor.

Vermont State Tax Software Preparation And E File On Freetaxusa

802-828-2865 or toll free in Vermont 866-828-2865 on Monday Tuesday Thursday and Friday from 745 am to 430 pm.

. Department of Taxes. Quick steps to complete and e-sign Vt homestead declaration online. Even if you do not believe you owe property taxes you must declare homestead in order to qualify for Property Tax Adjustment.

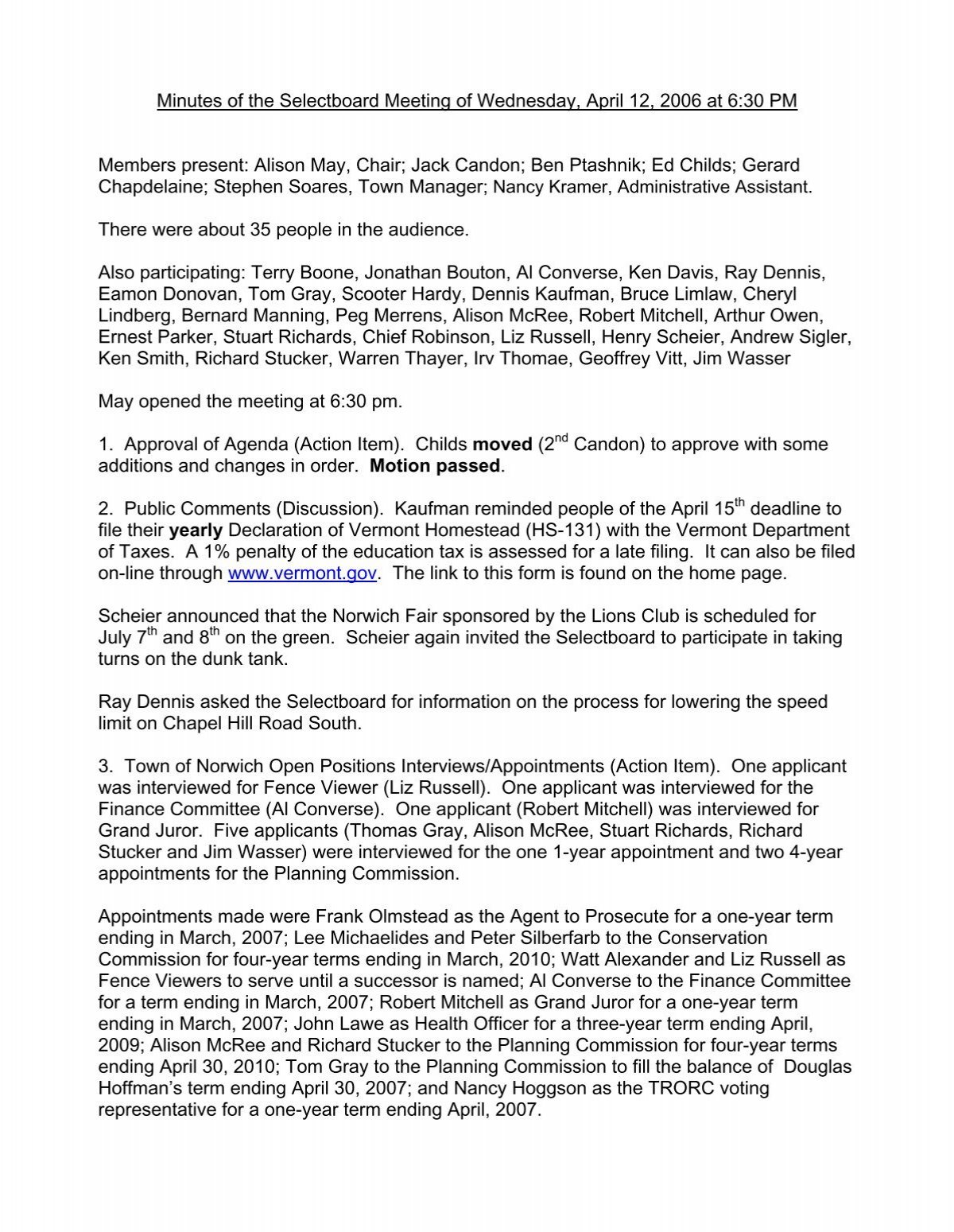

Domicile Statement Property Tax Homestead Declaration Domicile Statement Vermont Department of Taxes Phone. Homestead Declaration and Property Tax Adjustment Filing Vermontgov Freedom and Unity Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and. Mon 01242022 - 1200.

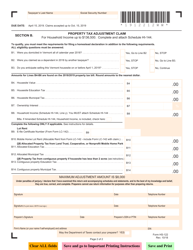

All groups and messages. Homestead Declaration and Property Tax Credit Filing Department of Taxes Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax. We last updated the Homestead Declaration AND Property Tax Adjustment Claim in March 2022 so this is the latest version of Form HS-122 HI-144 fully updated for tax year 2021.

Use the housesite value found on the 20212022 property tax bill of the property you own and occupy on April 1 2022. Vermont tax statutes regulations Vermont Department of Taxes rulings or court decisions supersede information presented here. Filing a Homestead Declaration is easy and can be done online at.

First Installmentof the 2022-2023 property taxes due 400 PM Tuesday November 15 2022 This property tax bill includes two installment coupons attached to the bottom and also includes. Start completing the fillable fields and. 802 828-2865 133 State Street Montpelier VT 05633-1401 For.

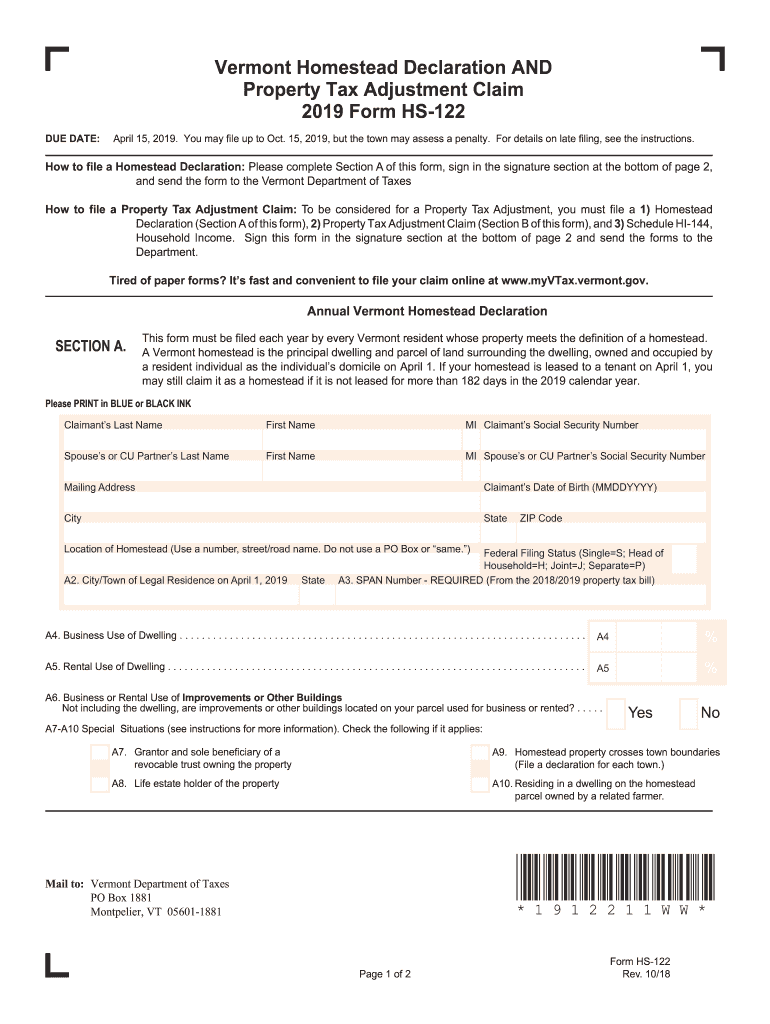

Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim. Tax examiners in this division can. Taxpayers having trouble filing Homestead Declarations and Property Tax Credit Claims may call 802 828-2865 for help.

Information on upcoming tax filing deadlines and.

Check Your Property Tax Bill Tax Dept Missed Deadline For Issuing Some Adjustments Vermont Public

Declaring Your Vermont Homestead Unusual Situations Youtube

Form Hs 122 Hi 144 Fillable Homestead Declaration And Property Tax Adjustment Claim

Understanding Your Property Tax Bill Department Of Taxes

Vt Form Hs 122 Download Fillable Pdf Or Fill Online Vermont Homestead Declaration And Property Tax Adjustment Claim 2019 Vermont Templateroller

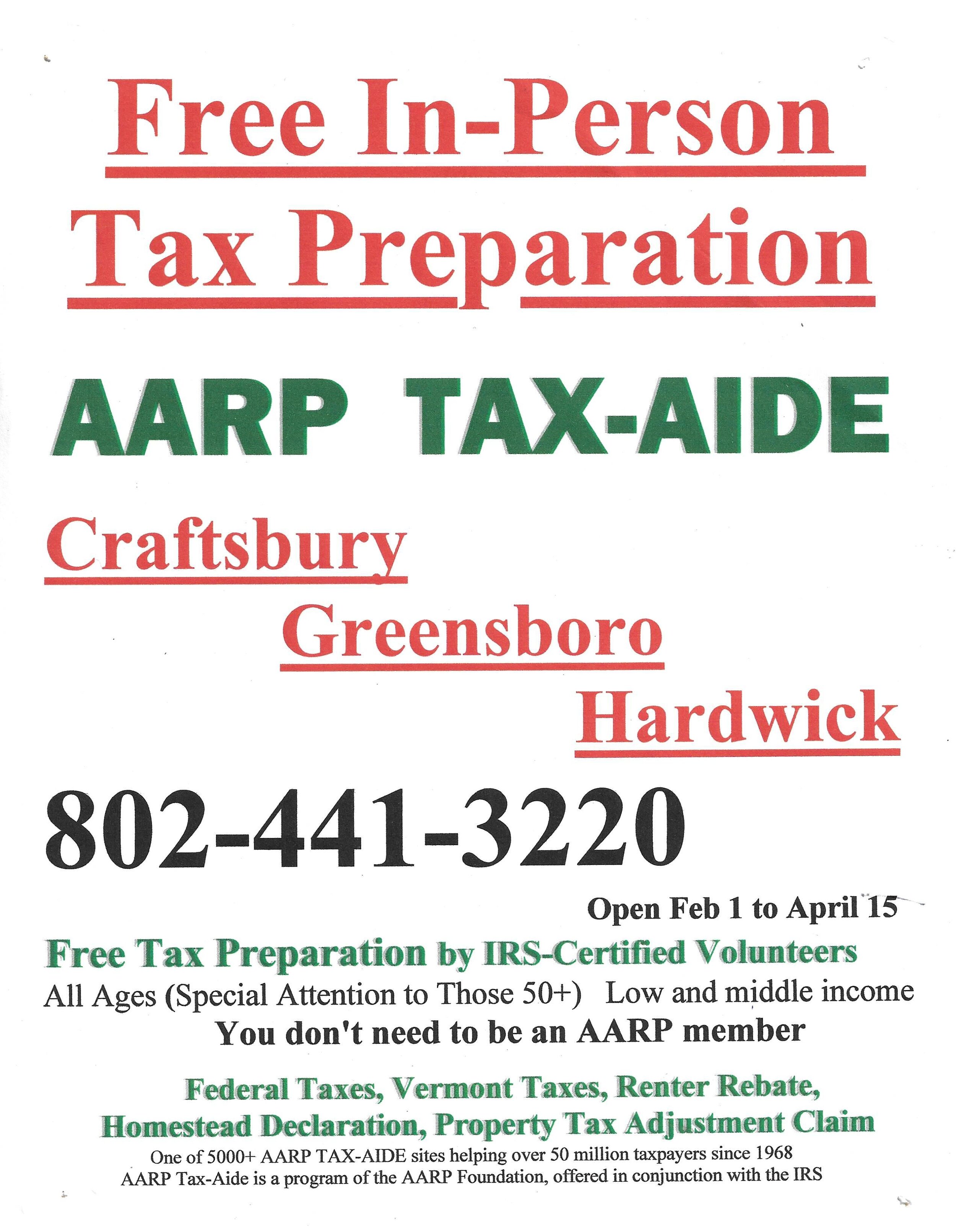

Vermont Tax Information Town Of Craftsbury

Vermont Tax Information Town Of Craftsbury

Vt State Tax Form Information Town Of Cave

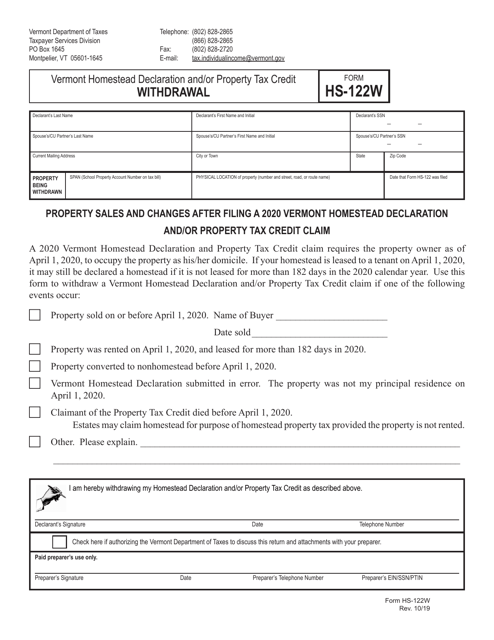

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Department Of Taxes Agency Of Administration Vermont Department Of Taxes Property Transfer Tax Return Online Service Proposal Created By The Vermont Department Ppt Download

Vt Dept Of Taxes Vtdepttaxes Twitter

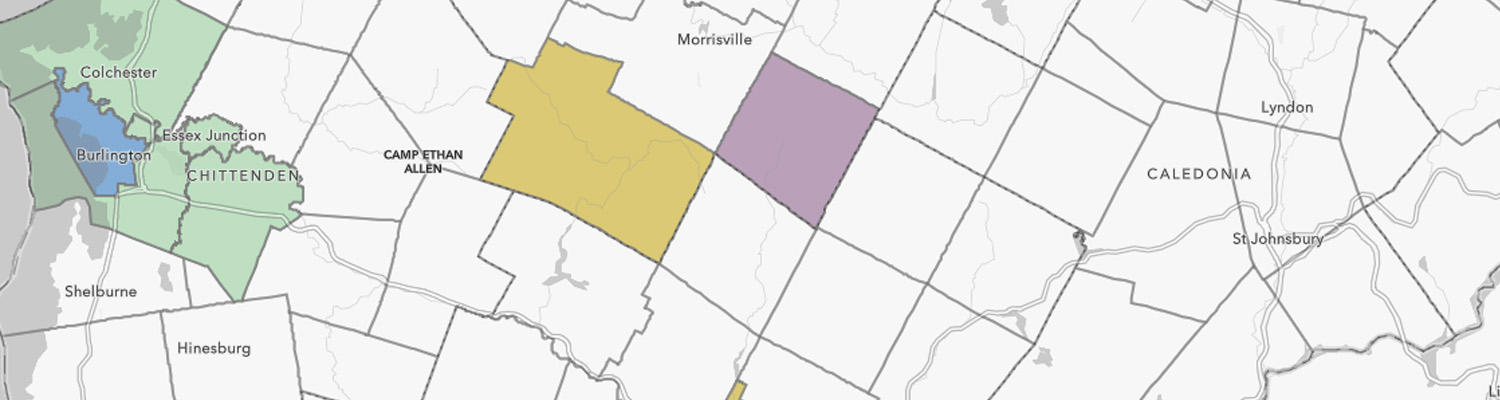

State Tax Treatment Of Homestead And Non Homestead Residential Property

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Homestead Form Hs 122 Fill Out Sign Online Dochub

Vt Form Hs 122 Download Fillable Pdf Or Fill Online Vermont Homestead Declaration And Property Tax Adjustment Claim 2019 Vermont Templateroller